Oakridge High School students are currently enrolling for 2012/13 courses. Senior Current Issues is the only course at our High School where you (the students) set the parameters of the curriculum. We will spend the first few days next Fall talking about issues in the world and in the nation, and then go about laying out plans for the semester. I am sure with 2012 as a presidential election year , that students will choose some role for the class in that election. I’m equally convinced that they will want to spend time on college scholarship searches as well. W hile we cover many other issues in class, national and international, we watch movies and we travel two times a year to Chicago as a group, scholarships for the past three years have been a chosen priority by Current Issue Seniors. They have seemed appreciative of the time and direction given to a thorough college scholarship search. I do not think that it is mere coincidence that students of Senior Current Issues have been historically successful in collecting college money.

hile we cover many other issues in class, national and international, we watch movies and we travel two times a year to Chicago as a group, scholarships for the past three years have been a chosen priority by Current Issue Seniors. They have seemed appreciative of the time and direction given to a thorough college scholarship search. I do not think that it is mere coincidence that students of Senior Current Issues have been historically successful in collecting college money.

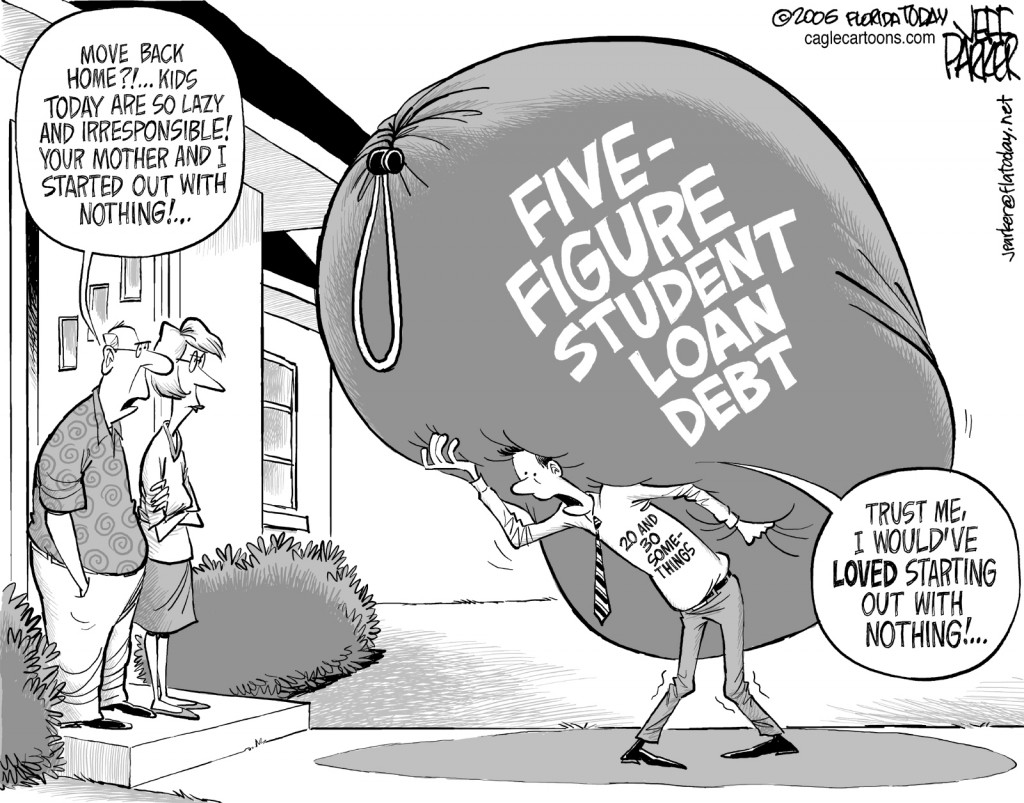

Your senior year is going to be extremely busy! You’ll have jobs and athletics and clubs and homework to deal with. Searching for and writing scholarship essays out of class is something that often gets pushed to the back burner in your final year of high school.

Not in Senior Current Issues – here it will be a priority. And in the end where you land in September of 2013 is so much more important to your future than walking across that stage in June.

You might want to consider this when enrolling for classes for next year.