Go here to learn more on how to pay back your student loans without ending up in the poor house.

Category Archives: LOANS & GRANTS – What YOU need to know

Pay As You Earn…the most valuable loan repayment program that nobody knows about

Comments Off on Pay As You Earn…the most valuable loan repayment program that nobody knows about

Filed under LOANS & GRANTS - What YOU need to know, Uncategorized

Good Loans, Bad Loans, & the PELL

First of all, before you can qualify for any loans or grants from the government you MUST have your parents fill out FAFSA!

Make sure this happens or everything else gets put on hold. You cannot even qualify for the T.I.P. if you do not fill out FAFSA! Once you’re accepted at a college you will be sent a financial aid package. This will be  individually tailored to your financial need. It will include grants (like the PELL) from the State and Federal government. It will also include proposed Loans – which you may or may not choose to sign for. It can also include things like Work-Study, which is a program that provides you an on-campus job as part of your package. Some of the loans that you will be offered will be subsidized and some unsubsidized. If you’ve been accepted at multiple schools, you will receive a separate aid package from each of the individual schools. Once you get your package call the financial aid office at the college with specific questions. Also bring into school to Mr. Wood or Kelsey or the Counseling Center for clarification.

individually tailored to your financial need. It will include grants (like the PELL) from the State and Federal government. It will also include proposed Loans – which you may or may not choose to sign for. It can also include things like Work-Study, which is a program that provides you an on-campus job as part of your package. Some of the loans that you will be offered will be subsidized and some unsubsidized. If you’ve been accepted at multiple schools, you will receive a separate aid package from each of the individual schools. Once you get your package call the financial aid office at the college with specific questions. Also bring into school to Mr. Wood or Kelsey or the Counseling Center for clarification.

Special Note here – this package from the university will NOT include separate scholarships that you may have won (such as Muskegon Community Foundation or Building a Better World). You will want to contact financial aid at the University to see how these scholarships alter your final package.

Lets take a look below at some of the basics below:

Go here for a Financial Aid calculator to estimate your college loan monthly payback schedule.

PELL GRANT – The Pell Grant is the Federal Government’s largest needs based grant awarded to college students. The most that you can get from a Pell Grant is $5500 per year. It is normally allocated in two equal portions between Fall and Winter semester. If your family income was less than $32,000 in 2012 you qualify for a full Pell Grant. The grant does not need to be repaid. Your parents must fill out the FAFSA for your to qualify for a Pell Grant.

Subsidized & Unsubsidized Federal Loans – If a loan is subsidized that means that interest is subsidized by the Federal government while you remain at least a half time student. You are responsible for the loan repayment, however with a subsidized loan you accrue NO interest on the loan until six month to nine months after you graduate college. In order to delay repayment you must be attending school at least half time. A subsidized loan is the best option you can have. If you take out a unsubsidized Federal loan interest accrues immediately, however you still do not pay back the loan as long as you are attending school at least half time. The interest rate is normally higher on a unsubsidized loan since these are not based on need. Private bank loans – non Federal loans – are a dangerous way to pay for school. These loans are not backed by the Federal government. You attain them through the private banking industry and you begin paying principle and interest immediately upon securing the loan. The difference between the two is huge. Stay away from unsubsidized private bank loans if at all possible.

PDF Chart on Federally based Loans.

Check out this “easy to read” Brochure from Fifth Third Bank. It provides an accurate summary of the entire college borrowing experience. The fact that it is written by a private bank and stresses private bank loans LAST is significant, and should serve to remind that you go Federal First.

Perkins Loan is a great loan – The Perkins Loan is a subsidized, low interest (5%), needs based loan, good for up to $5,000 per year. Perkins Loans are eligible for Federal Loan Cancellation for teachers in designated low-income schools or shortage subject areas like math or science, or bilingual education. In either case you can have a certain percentage of your loan forgiven for each year that you teach. You may also qualify for reduction of a Perkins loan for service in the Peace Corps. It is the best loan that you can get.

Subsidized Stafford Loans are good loans – The Stafford Loan (also referred to as a Federal Direct Student Loan) may be subsidized or non-subsidized. Make sure that you know which one your school has offered to you as part of your financial aid package. The subsidized Stafford Loan is obviously better than unsubsidized version, since interest does not accrue while you are in school and in the end it costs less, the unsubsidized version is far superior to a private bank loan (learn more details here). In July of 2012 the interest rate for subsidized Stafford Loans will rise from 3.4% to 6.8%. The interest rate for an unsubsidized Stafford Loan will remain at 6.8%. This increase of Stafford Loan interest rates is another example of your Federal government devaluing education and public goods. Educate yourself to how politics dictates these things.

Direct Plus Loans for parents – The Direct Plus Loan for “parents only” is a signature loan that is often offered by Universities as part of a financial aid package. While the 7.9% interest rate is not as good as the Stafford or Perkins, a signature loan does not require collateral. Parents do not need to put up property to get the loan, they merely need to have adequate credit. Repayment however, begins at the time the loan is dispersed. This means that your parents begin paying it while you are attending school. This is not such a great option, however (because of the signature aspect) it too is better than going to a bank where you must have adequate collateral (house, property, etc) to qualify.

Again the key on loans – is subsidized or unsubsidized – Federal or Private. The Pell Grant is great! College based grants and loans offered from the University often require that you maintain a specific GPA to renew. To make sure that you know the specifics for each of your loans and grants in your financial aid package, call the Financial Aid department and have them walk you through your financial aid package.

Don’t forget the Federal Work Study Program. The Work Study Program provides funds for part-time employment to help needy students to finance the costs of postsecondary education. Students can receive FWS funds at approximately 3,400 participating postsecondary institutions. Hourly wages must not be less than the federal minimum wage. Work Study jobs are very very user friendly in working around your class schedule. A lot of the jobs are campus related. Dorm desk jobs, library, cafeteria, office work in a specific department – you can usually find available jobs online or at your university’s financial aid center.

Make sure if at all possible to stay away from private bank loans in financing your education. And don’t ever put it on a credit card!

Make sure if at all possible to stay away from private bank loans in financing your education. And don’t ever put it on a credit card!

Comments Off on Good Loans, Bad Loans, & the PELL

Filed under LOANS & GRANTS - What YOU need to know

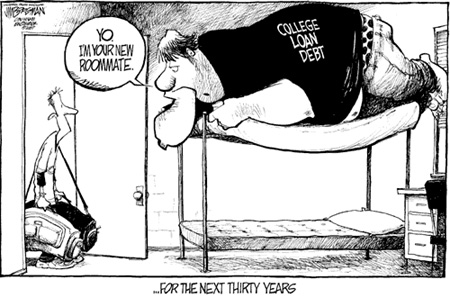

DO NOT BE AFRAID – of taking out College Loans?

Don’t panic on this College Loan thing…

The only thing worse than signing any and every single loan application that comes across your plate – without knowing the long term implications, is to sign nothing. You cannot be afraid of all loans. You cannot procrastinate the situation, refuse to look at taking on some debt, and not go to college because you may have to face a reasonable monthly bill for getting an education. Be smart. Do your homework. Weigh the pros and cons of the price tag of various college and do a little comparison shopping here.

look at it this way…

Think of all of those high school seniors who go straight from school into the workforce…most likely into an underpaid and dead end service sector job, with bad or non existent health care benefits. Many of those kids use their new found wealth to buy a new car. Well, lets look at some of the comparisons.

- 2012 Toyota Camry – costs $22,500 + $1,350 (tax) title and extras = $25,000

- $25,000 loan for 63 months at 3.67% interest – $440.44 month – total loan $27,747

So here’s your opportunity cost:

- COLLEGE

- $25,500 average debt for a college grad in 2010

- $293 a month loan repayments for ten years

- Total Loan – $35,214

- CAR

- $25,000 – 2012 Camry (title, tax, license)

- $440 a month loan repayments for five 1/2 years

- Total Loan – $27,747

And once you have a degree according to 2008 statistics:

- The avg earnings of full-time worker with a bachelors degree $55,700

- The avg earnings of full-time worker with a high school diploma $33,800

Comments Off on DO NOT BE AFRAID – of taking out College Loans?

Filed under LOANS & GRANTS - What YOU need to know, Uncategorized

Students, Your Loan Rate is about to Double – WAKE UP!

Please go here for a detailed look at College Loans and Grants.

And go here to read how Congress is reducing its financial support for college students at the very time that tuition is rising through the roof.

Prepare yourself: on July 1, as many as 8 million college students will see their interest rates on federally subsidized student loans double, from 3.4% to 6.8%. According to the U.S. Public Interest Research Group, that increase amounts to the average Stafford loan borrower’s paying $2,800 more over a standard 10-year repayment term for loans made after June 30. It’s worse for those students who take out the most money. Those who borrow the maximum $23,000 in subsidized student loans will see their debt load upped by $5,000 over a 10-year repayment plan and $11,000 over a 20-year repayment plan.

3.4% to 6.8%. According to the U.S. Public Interest Research Group, that increase amounts to the average Stafford loan borrower’s paying $2,800 more over a standard 10-year repayment term for loans made after June 30. It’s worse for those students who take out the most money. Those who borrow the maximum $23,000 in subsidized student loans will see their debt load upped by $5,000 over a 10-year repayment plan and $11,000 over a 20-year repayment plan.

This is an excellent example of why you need to pay attention to what is happening in Washington D.C. There is a huge difference between Democrat and Republican positions in regards to financing of higher education. The Republican House Proposed Budget 2012 is not only calling for an end to subsidized Stafford Loans for students of low-income families, it also advocates for lowering the qualification for the full Pell Grant from a family income of $32,000 down to $15,000. $15,000? That’s not enough to raise a family in much more than a cardboard box on the side of the street. After adjusting for inflation, a $15,000 income threshold would be the least generous automatic- zero EFC provision in the history of the Pell Grant program, at a time when tuition is at historic highs. The Obama Budget on the other hand, has proposed legislation to keep the 3.4% interest rate for subsidized Stafford Loans for needy families and advocates an increase in the Pell Grant maximum from $5500to $5635 in 2012/13. Again, in a country as wealthy as ours this lack of support for the students of higher education is abysmal, but its far better than the Republican alternative.

Hard economic decisions must be made in this country if we are to reduce a $14 trillion debt. You must make your own call on who you support at the state and national level in regards to this and many other significant issues that face this nation. However, political choices that balance the budget on the backs of young people who are already suffering from crushing college debt, must be recognized and called out.

It is important for you to understand and consider these differences when making your own political decisions. Time to get informed people. Time to wake up!

Comments Off on Students, Your Loan Rate is about to Double – WAKE UP!

Filed under LOANS & GRANTS - What YOU need to know, NEWS on College & College Funding, Uncategorized

How to Interpret Your College Financial Aid Letter

By April, seniors will be receiving letters from their perspective colleges. The letters sent by the Financial Aid offices lay out the expected cost of school for 2012-13 and the aid package proposed by the University. That package will include grants and loans and work study. The key is NOT the final amount which you are expected to contribute.

The key is how that package is broken down. You need to understand the differences between subsidized and unsubsidized loans. Go here for that information. You also need to find out if you must maintain a specific GPA to keep your financial aid. You need to know if you must maintain full or part time status to keep your financial aid. You need to know if a specific grant or loan is renewable or if it is a one year only offer. All of these things are important.

This link provides you a generic financial aid letter that will help you to translate your financial aid package. Take a look and bring your letter to class or the counseling office. Make sure that I or Kelsey or a counselor go over that letter with you. Make sure that your parents understand its implications as well.

Make sure that you understand all of your financial responsibilities before signing on the dotted line…particularly when it comes to the loans.

Comments Off on How to Interpret Your College Financial Aid Letter

Filed under LOANS & GRANTS - What YOU need to know, NEWS on College & College Funding